Question 5.6: Long-Term Versus Short-Term Loans You work for a bank that h...

Long-Term Versus Short-Term Loans

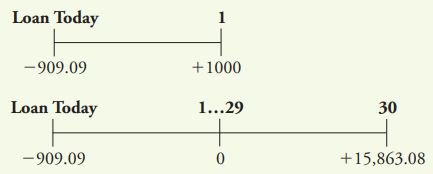

You work for a bank that has just made two loans. In one, you lent $909.09 today in return for $1000 in one year. In the other, you lent $909.09 today in return for $15,863.08 in 30 years. The difference between the loan amount and repayment amount is based on an interest rate of 10% per year. Imagine that immediately after you make the loans, news about economic growth is announced that increases inflation expectations, so that the market interest rate for loans like these jumps to 11%. Loans make up a major part of a bank’s assets, so you are naturally concerned about the value of these loans. What is the effect of the interest rate change on the value to the bank of the promised repayment of these loans?

Learn more on how we answer questions.

Plan

Each of these loans has only one repayment cash flow at the end of the loan. They differ only by the time to repayment:

The effect on the value of the future repayment to the bank today is just the PV of the loan repayment, calculated at the new market interest rate.

Execute

For the one-year loan:

For the 30-year loan:

PV =\frac{\$15,863.08}{(1.11)^{30}} = \$692.94Evaluate

The value of the one-year loan decreased by $909.09 – $900.90 = $8.19, or 0.9%, but the value of the 30-year loan decreased by $909.09 – $692.94 = $216.15, or almost 24%! The small change in market interest rates, compounded over a longer period, resulted in a much larger change in the present value of the loan repayment. You can see why investors and banks view longer-term loans as being riskier than

short-term loans.