Question 8.A.2: Bond Pricing with Semiannual Coupon Payments PROBLEM: A corp...

Bond Pricing with Semiannual Coupon Payments

PROBLEM: A corporate treasurer decides to purchase a 20-year Treasury bond with a 4 percent coupon rate. If the current market rate of interest for similar Treasury securities is 4.5 percent, what is the price of the bond?

APPROACH: Treasury securities pay interest semiannually, so this problem is best worked on a financial calculator because of the large number of compounding periods.

We can convert the bond data to semiannual compounding as follows: (1) the bond’s semiannual yield is 2.25 percent (4.5 percent per year/2 = 2.25 percent), (2) the semiannual coupon payment is $20 [($1,000 × 4 percent)/2 = $40/2 = $20], and (3) the total number of compounding periods is 40 (2 periods per year ×20 years = 40 periods). Note that at maturity, the bond principal, or face value, of $1,000 is paid to the investor. Thus,the bond’s time line for the cash payments is as follows:

Learn more on how we answer questions.

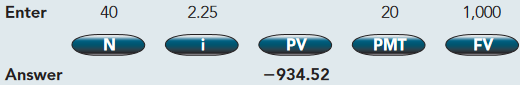

We can enter the appropriate values on the financial calculator and solve for the present value:

The bond sells for a discount, and its price is $934.52.