Question 23.7: Camacho Enterprises is a U.S. company that is considering ex...

Camacho Enterprises is a U.S. company that is considering expanding by acquiring Xtapa, Inc., a firm in Mexico. The acquisition is expected to increase Camacho’s free cash flows by 21 million pesos the first year; this amount is then expected to grow at a rate of 8% per year. The price of the investment is 525 million pesos, which is $52.5 million at the current exchange rate of 10 pesos/$. Based on an analysis in the Mexican market, Camacho has determined that the appropriate after-tax peso WACC is 12%. If Camacho has also determined that its after-tax dollar WACC for this expansion is 7.5%, what is the value of the Mexican acquisition? Assume that the Mexican and U.S. markets for risk-free securities are integrated and that the yield curve in both countries is flat. The U.S. risk-free interest rates are 6%, and Mexican risk-free interest rates are 9%.

Learn more on how we answer questions.

PLAN

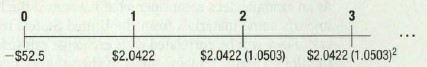

We can calculate the NPV of the expansion in pesos and convert the result into dollars at the spot rate. The free cash flows (in millions) are:

We can also compute the NPV in dollars by converting the expected cash flows into dollars using forward rates. The N-year forward rate (Eq. 23.2) expressed in pesos/$ is:

\text{Forward Rate}_T= \text{Spot Rate} \times \frac{(1+r_€)^T}{(1+r_\$)^T} (23.2)

F_N = S \times \frac{(1+r_p)^N}{(1+r_\$)^N} = 10\times \left(\frac{1.09}{1.06} \right)^N = 10 \times 1.0283^N = 10.283 \times 1.0283^{N-1}EXECUTE

The net present value of the peso cash flows at the peso WACC is:

NPV = \frac{21\text{ pesos}}{0.12-0.08} – 525 pesos = 0

Thus, the purchase is a zero-NPV transaction. Presumably, Camacho is competing with other Mexican companies for the purchase.

To compute the NPV using the dollar WACC, we need to convert the peso cash flows to dollar cash flows. The dollar-expected cash flows are the peso cash flows, denoted C^N _{pesos,} (from the earlier timeline) converted at the appropriate forward rate, FN. We divide by the forward rate because it is in pesos/$:

The dollar-expected cash flows are therefore:

Thus, the dollar cash flows qrow at about 5% per year. The NPV of these cash flows is:

NPV = \frac{\$2.0422}{0.075-0.0503} – $52.5 = $30.18 million

EVALUATE

We calculated two different NPVs, but which NPV more accurately represents the benefits of the expansion? The answer depends on the source of the difference. To compute the dollar-expected cash flows by converting the peso-expected cash flows at the forward rate, we must accept the assumption that spot rates and the project cash flows are uncorrelated. The difference might simply reflect that this assumption failed to hold. Another possibility is that the difference reflects estimation error in the respective WACC estimates.

If Camacho is relatively confident in its assumptions about spot rates and its WACC estimates, a third possibility is that Mexican and U.S. capital markets are not integrated. In this case, Camacho, because of its access to U.S. capital markets, might have a competitive advantage. Perhaps other companies with which it is competing for the purchase of Xtapa are all Mexican firms that do not have access to capital markets outside of Mexico. Hence, Camacho can raise capital at a cheaper rate. Of course, this argument also requires that other U.S. companies not be competing for the purchase of Xtapa. Camacho, however, might have special knowledge of Xtapa’s markets that other U.S.-based companies lack. This knowledge would give Camacho a competitive advantage in the product market over other U.S. companies and would put it on an equal footing in the product market with other Mexican companies. Because it would have a competitive advantage in capital markets over other Mexican companies, the NPV of the purchase would be positive for Camacho, but zero for the other bidders for Xtapa.