Question 8.4: Hindenberg, Inc., has a 10-year bond that is priced at $1,10...

Hindenberg, Inc., has a 10-year bond that is priced at $1,100.00. It has a coupon of 8 percent paid semiannually. What is the yield to maturity on this bond?

The blue check mark means that this solution has been answered and checked by an expert. This guarantees that the final answer is accurate.

Learn more on how we answer questions.

Learn more on how we answer questions.

The time line for Hindenberg’s 10-year bond looks like this:

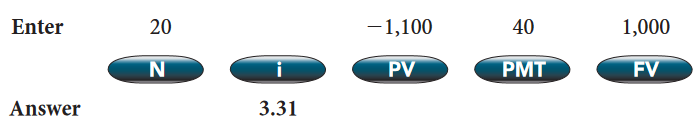

The easiest way to calculate the yield to maturity is with a financial calculator. The inputs are as follows:

The answer we get is 3.31 percent, which is the semiannual interest rate. To obtain an annualized

yield to maturity, we multiply this by two:

YTM = 3.31% × 2

YTM = 6.62%

Related Answered Questions

Question: 8.1

Verified Answer:

DECISION: First, the staff’s strategy is based on ...

Question: 8.A.4

Verified Answer:

We can solve for the yield to maturity using a fin...

Question: 8.A.3

Verified Answer:

Using Equation 8.1 (or 8.2), the setup is as follo...

Question: 8.A.2

Verified Answer:

We can enter the appropriate values on the financi...

Question: 8.A.1

Verified Answer:

To prove the answer is correct (or wrong), we can ...

Question: 8.1

Verified Answer:

The time line and calculations for the five-year b...

Question: 8.5

Verified Answer:

You have the following information about Highland’...

Question: 8.2

Verified Answer:

We can find the price of Bigbie Corp.’s bond as fo...

Question: 8.3

Verified Answer:

We start with a time line for Rockwell’s bond:

Us...